This article is a spin-off from the ongoing DigiChina Forum on the Chinese government's 14th Five-Year Plan for National Informatization. Read other entries here.

Chinese policymakers looking to increase economic productivity have in recent years identified what they see as an abundant but inefficiently used resource: data. In April 2020, the State Council formally designated data as a factor of production, joining land, labor, capital, and technology. Ever since, the concept of "market-based allocation of factors" (要素市场化配置) has made its way into industrial policies at national and provincial levels, with the allocation of data resources a major focus.

The 14th Five-Year-Plan for National Informatization, an overarching blueprint for tech modernization through 2025, makes the establishment of highly efficient data factor resource systems a top priority. The Plan aims to “activate the factor value of data, enhance the role of data as a factor endowment, shape a strong domestic market that is innovation-driven, high-quality, supply-led, and creates new demand.” To further these goals, public data related to demographics, transportation, and telecom would be shared through a unified national open data platform. Companies would be encouraged to provide access to their proprietary data in search, e-commerce, and social networking.

Unlocking the Societal Value of Data Stores

Underlying these sweeping top-down efforts to put data to work is the idea that economic efficiency would be enhanced at a societal level if data can flow to economic agents who make productive use of it. This conceptual formulation has motivated initiatives to promote open government data as well as national industrial databases. Guangdong, a pilot province for open government data, formally prohibits government offices from treating public data as private property or hindering its open utilization.[1]

But data factor allocation is not without potential pitfalls. A tragedy of the commons could arise if data controllers acting in their own interest under-contribute to the common good despite benefitting from public data. Unless it is under public ownership, data is best characterized as a semi-public good, non-rivalrous but potentially excludable. In other words, the use of a particular data resource need not deplete it as if it were an oil deposit, yet one party could still limit or exclude others from accessing it.[2] Without intervention, private firms have little incentive to share their data crown jewels in a way that would level the playing field for new entrants, even if they do enjoy the benefits of public data.

China's government is increasingly willing to play up the advantages of Socialism with Chinese Characteristics. A subtle phrase from the new Plan—“better integration of efficient markets and active government”—captures this spirit. One implication of this approach could be state intervention to break what are known as "data silos," stores of data currently kept for the exclusive use of private sector or government actors, and put the data to work more widely in the economy. SOEs, particularly state-backed financial institutions, may be mandated to contribute, with private firms pressured to follow suit. Ant Group’s agreement to fully integrate its consumer credit data into a credit reporting system controlled by China's central bank exemplifies the possibility of making privately held data more widely accessible.

Incentivizing Sharing, but Not Over-Sharing

To pursue state-driven data factor allocation is to operate on a key assumption. Although businesses and government agencies could theoretically share resources through licensing or outright sale of data stores, the thinking goes, there is at least some productivity-enhancing reallocation of data that does not take place organically. To address this, the government could build out technological and legal infrastructure to spur data transaction activities and unlock value. Government-backed data exchanges would reduce transaction costs[3] by facilitating mutual discovery between demand and supply, increasing market liquidity, and providing a venue for dispute resolution.

Yet, low transaction costs alone would not incentivize data controllers to put high-value data on the shelf. Data pricing surely presents an obstacle, but a more fundamental obstacle is that data Goliaths do not want any price tags attached to their data—not only because there are commercially viable ways to monetize such data, but also because data pricing hands antitrust authorities a perfect toolkit for assessing their data-fueled market power.

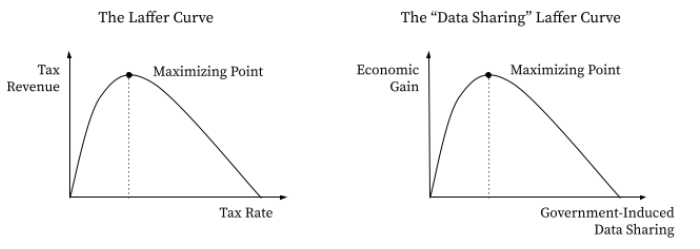

To pull off its ambition to put data to work, China will have to chart out a path on a few open-ended issues to which no other country has found perfect answers. Much like the inverted U-relationship between tax rate and tax revenue (“the Laffer Curve”), there may exist a similar relationship between government-induced data sharing and economic efficiency gain. The carrots and sticks that unlock high-quality data supply initially lead to higher productivity. But once data sharing shoots past an optimal level, data controllers might begin to question whether their competitors benefit from the data more than they do. As a result, certain data collection and processing activities could be cut back, undermining efficiency gains.

Equally important is the trade-off between security and development. If data offers value, how can you prevent that data from falling into the wrong hands, given the national paranoia about data security? Privacy computing points to a promising but computationally expensive workaround. But unless and until such technological solutions are widely adopted, managing the security-development trade-off will be more of a public policy choice.[4] China is in the early phases of operationalizing the Personal Information Protection Law and the Data Security Law, and sectoral regulationson data classification are being gradually introduced. Forthcoming regulatory details about "important data" will help determine what data can be shared and how. Recognizing the economic value of data certainly has a bearing on where policymakers will draw the line between security and development.

Uncertainty Factors

Amid this evolving regulatory environment, the major question of data ownership remains a legal vacuum, despite the fact that market-driven data factor allocation hinges on a set of clearly defined rights to data. Chinese scholars hold views that run the gamut from outright rejection of data ownership to proposals of layered rights to data. If data ownership were to be introduced, the ensuing exclusivity would have profound ramifications for market participants along the data lifecycle and between competing firms. China is neither the first nor the only country to consider legal innovation in data ownership, but the outcomes are anything but clear.

Data ownership is just one theme to watch as China builds out a data factor resource system. Others include how rights to own, use, or profit from data are defined. Will data controllers participate in data exchanges as a show of alignment with state goals or based on market dynamics? Will privacy computing technologies mature to ameliorate the tension between security and development? If the Chinese government manages to put data to work, it could be a catalyst for transitioning the economy toward the high-quality growth it has long pursued.

The author thanks Graham Webster for his valuable comments and editing. All views expressed only represent the personal opinions of the author.

[1] Article 4 of Guangdong Public Data Management Measures states “Given that public data is a new type of public resource, any enterprise or individual should not regard public data as private property, or obstruct its sharing, open access, development and utilization.”

[2] Charles Jones and Christopher Tonetti emphasize non-rivalry in their model and acknowledge that data can be made highly excludable. One of their main conclusions is that “there can be large losses when a nonrival input is not used broadly.” Similarly, Hal Varian finds data access non-rivalrous but excludable.

[3] China is home to more than 20 big data exchanges. The earliest one was founded in 2015 in Guizhou, a pioneer province in big data-related projects. Its operation ground to a halt, nowhere near the lofty goal of achieving 10 billion RMB revenue within 3~5 years of founding. The current wave differs in that the policy push comes from the central government. Cities with vibrant digital economies—including Beijing, Shanghai, and Shenzhen—have introduced data governance policies and established local data exchanges.

[4] For example, a bank may buy data to learn the total amount of outstanding loans a hypothetical borrower has accumulated at other banks, without knowing the exact loan amount at each bank. Privacy computing holds the promise of making data “accessible but not visible,” a frequently mentioned goal in data-related development policies.